Number crunching how to prevent a 2 degC rise Figures courtesy of McGlade, Ekins: Letter to Nature

As a petroleum engineer, I saw first-hand the decline in mature reservoirs in locations as diverse as the North Sea, onshore Romania and Dubai. I believed the traditional view that the global oil industry would start to slow naturally as economically viable supply dried up and rising fossil fuel prices drove the development of new energy sources and technologies. I have had to re-examine this theory recently in my research at the UCL Energy Institute, finding out that it may be necessary to leave economical reserves in the ground to prevent runaway climate change by stabilising CO2 levels. Given this evidence, do we need immediate intervention in global markets to accelerate the transition to cleaner energy?

Throughout 2014 and 2015 there was a global oversupply of up to 2 million bbl/day of oil resulting in the cut in production announced recently by OPEC in an attempt to stabilise oil prices. Although much of this was down to a slowdown of rapidly growing Asian economies and other factors, significant factors were the increases in production from US shale and OPEC Middle East members battling to maintain market share.

The enforced cut in supply has raised awareness that mature reserves are being replaced fast enough globally to more than match demand in the short term. The age of cheap oil is not over yet and without any intervention, greenhouse gases may rise beyond what is considered viable currently.

In my opinion, the fundamental question is that if supply and demand are not going to control the need to exploit fossil fuel resources, what levers can be used instead by investors and governments? A couple of approaches have been examined in more detail: the stick approach of divesting funds from fossil fuel companies and the carrot approach of providing subsidies for clean technologies.

One option on the table has been the growing movement of divestment. By encouraging universities, public organisations and ethical pension funds to remove shares from fossil fuel companies from their portfolios, it has been suggested that there will be less investment to develop oil and gas producing assets in the future.

One option on the table has been the growing movement of divestment. By encouraging universities, public organisations and ethical pension funds to remove shares from fossil fuel companies from their portfolios, it has been suggested that there will be less investment to develop oil and gas producing assets in the future.

This makes sense on the surface: less money in means less money out? Actually, with market forces, the effect is believed to be more complex. As ethical investors pull funds, any falls in the share prices of fossil fuel companies leads to increased demand from ‘non-ethical’ investors leading to price stabilisation. Long term, the only way to counteract this effect is to convert ‘non-ethical’ into ethical investors, thereby increasing their market influence.

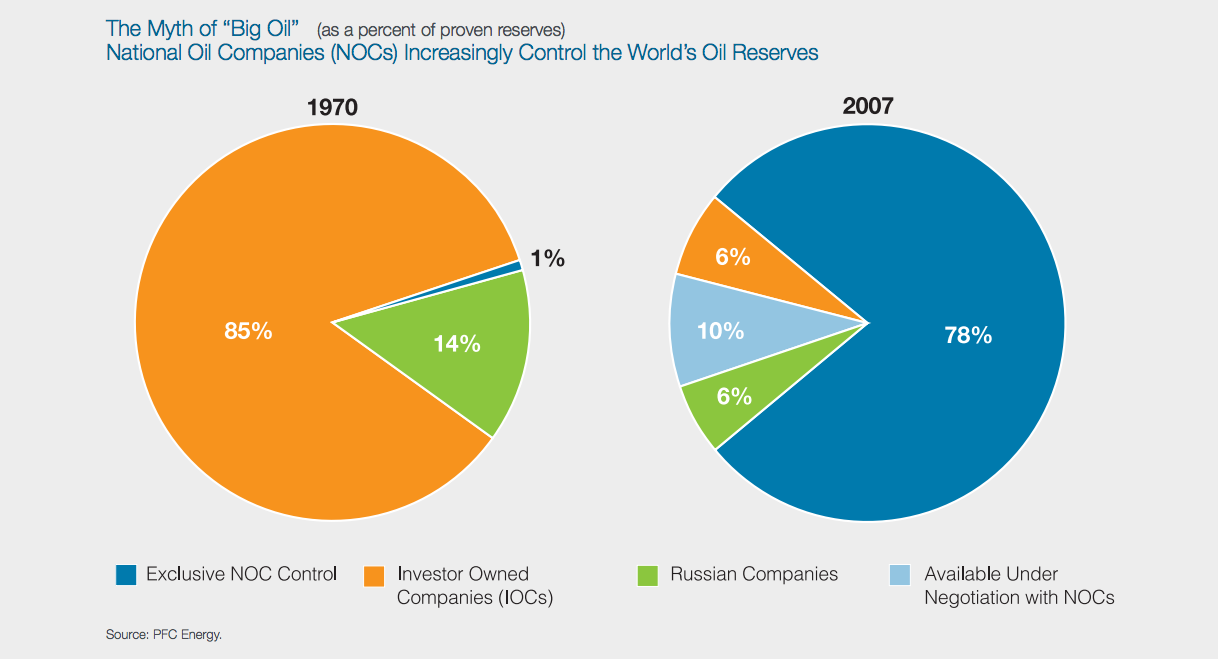

A major issue with divestment that I put forward for discussion at a Grantham Institute panel discussion was that it only targets big multinational producers such as Exxon, Shell and BP. As such there are no levers to influence the national oil companies majority owned by governments such as Saudi Aramco and Gazprom, which make up around 90% of the global reserves and oil production.

Recently, clean energy subsidies have been in the press for the wrong reasons; as Northern Ireland’s Renewable Heat Incentive scheme which could cost £1 billion due to loopholes. However evidence has shown that where subsidies are well thought out, they drive the development of new technologies and infrastructure.

Recently, clean energy subsidies have been in the press for the wrong reasons; as Northern Ireland’s Renewable Heat Incentive scheme which could cost £1 billion due to loopholes. However evidence has shown that where subsidies are well thought out, they drive the development of new technologies and infrastructure.

Subsidies may seem an unfair competitive advantage against fossil fuel companies, but in reality the development of coal and oil resources has been subsidised by governments throughout the last two centuries. This doesn’t just include $5.3 trillion globally for access to cheaper energy, but also decommissioning costs and recent freezes in UK fuel duty.

Subsidies don’t just help households but also encourage a boom in start ups building a competitive market. I believe that the UK government’s recent reduction in renewable energy subsidies will slow this growth at a time when we may start to see lower wholesale prices due to this boom.

I am convinced that the future for clean energy resources is bright given that prices for wind and solar energy are reducing steadily with time (see below). Targeted subsidies have been shown to accelerate this by encouraging take up of new technologies and the development of improvements. However, I strongly believe that fossil fuel divestment could be a red herring which pushes fossil fuels market share into the hands of less ethical investors or out of the control of the free market.

Cost of solar reducing with time. Ref: Berkeley Labs

2 Comments

Hi Duncan,

I could go on forever about this as you may know that we built a so-called eco-house here in Kintyre.

To be brief: I firmly believe that the priority should be to reduce demand for energy full stop!

Then that energy should be produced where it is required (i.e. in the centres of population or industry, rather than in rural areas. 2 reasons: wind turbines and their associated pylon lines, which are proliferating mainly because we know how to do it, are not only an eyesore, but also inefficient given the loss of electricity over distance.)

As regards the subsidies for PV panels and renewable heat such as pellet boilers, we personally benefit from both. In the first instance, despite being able to look at the experiences of other governments such as Germany, the British government was over generous and had to cut back, creating massive and unrealistic demand followed by companies going out of business. In the second instance, the assessment of the incentive required is so vague it hardly makes sense. How clever do you have to be to work out appropriate rates? People are now contacting us trying to buy our roof!!!

Beyond our own shores, in less developed countries where there is more sun, solar PV and water have to be the future. If energy could be transported without such losses, they could even sell power to northern countries.

I could rant on forever but it wouldn’t be helpful. I’m glad to see an oil techie such as yourself looking at these matters and if there’s anything in our experiences which might be useful, please feel free to get in touch.

“The Energy in Scotland 2016” report produced by the Scottish Government demonstrates what is possible when ongoing focus is applied to reducing consumption and increasing generation from renewable resources. Scotland accounts for 10% of UK energy consumption, but plans to have 100% renewable generation of electricity by 2020, while reducing consumption by 12%. Progress was reported in December 2016 as “an equivalent of 59.4 per cent of Scotland’s gross electricity consumption was met from renewable sources in 2015”

Surely progress to be really proud of.

Time for the UK government to review its priorities, to reduce our reliance on hydrocarbon and reduce our reliance on NOCs beyond our political boundaries?